- HOME

- Sustainability

- Materiality 1

Reduce the environmental impact of our business activities - Climate change (information disclosure based on TCFD recommendations)

Climate change (information disclosure based on TCFD recommendations)

We recognize that addressing climate change is a material issue for the PPIH Group's sustainable development as well as the enhancement of corporate value over the medium to long term. In order to accelerate and ensure our efforts, we endorsed the Task Force on Climate-related Financial Disclosures("TCFD")in February of 2022 and conducted scenario analysis and disclosure based on the TCFD framework. We will continue with our efforts to address climate change and expand disclosures.

Governance

The Sustainability Committee, under the leadership of the Director, Managing Executive Officer and CAO, who is the officer in charge of sustainability, plans and formulates countermeasures and reflects them in the business activities of Group companies.

The Sustainability Committee reports to the Board of Directors at least once a year on the progress of sustainability initiatives, including climate change, and the status of achieving targets. Policies, strategies, and important initiatives related to climate change are discussed and approved by the Board of Directors to implement sustainability measures.

The Sustainability Committee is chaired by the Executive Officer and the Head of IR Headquarters, meets once a month. We receive reports from subcommittees of sub-organizations on our responses to sustainability issues, including climate change, and set targets, manage progress, and monitor them. In addition, we hold regular meetings with outside committee members with specialized knowledge in sustainability management to build a system that allows them to work from a professional perspective.

Governance Structure and Roles Related to Climate Change (FY ending June 2025)

| Organization | Member | Role | Number of Reports and Events |

Fiscal year ending June 25 Main Reports and Deliberations |

|---|---|---|---|---|

| Board of directors |

Director Auditor |

|

Twice a year |

|

| Sustainability Committee |

[Chair] Executive Officer and Head of IR Headquarters [Members] Head of Related Departments (Environmental Measures, Design, Facility Management, Disaster Countermeasures, Crisis Management, Store Compliance, Product Procurement Department, Quality Control, Fair Trade Management, Legal Affairs) [Outside Members] Hidemi Tomita (Representative Director, Sustainability Management Research Institute) |

|

12 times a year (1 time per month) |

|

Strategy: Scope of analysis

[1.5°C and 4°C scenarios]

According to the Intergovernmental Panel on Climate Change (IPCC) Sixth Assessment Report (AR6), the change in global average temperature until 2100 is divided into five scenarios by increasing or decreasing CO₂ emissions.

In addition, various institutions and organizations have published multiple scenarios, but we conducted a scenario analysis based on the 1.5°C and 4°C climate scenarios because (1) it is not strategic to formulate countermeasures for all possible futures, and (2) it is easy to deal with the results of both ends when the results are between them.

| 1.5°C Scenario | 4°C Scenario | |

|---|---|---|

| Expected society | A society in which social changes associated with the transition to a decarbonized economy are likely to impact business operations, in order to limit the rise in global average temperature to 1.5°C by the end of this century |

|

| Referenced scenarios | IEA「Word Energy Outlook 2024」Net Zero Emissions by 2050 Scenario |

|

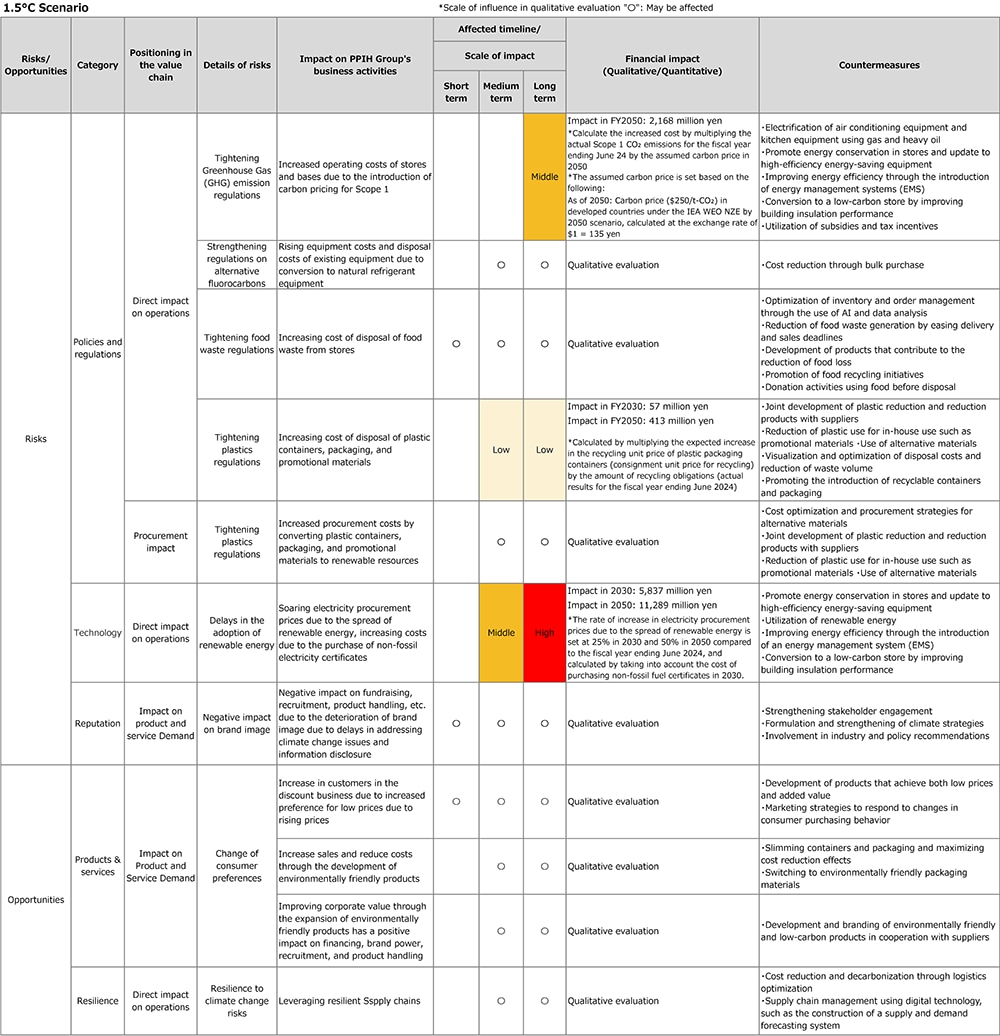

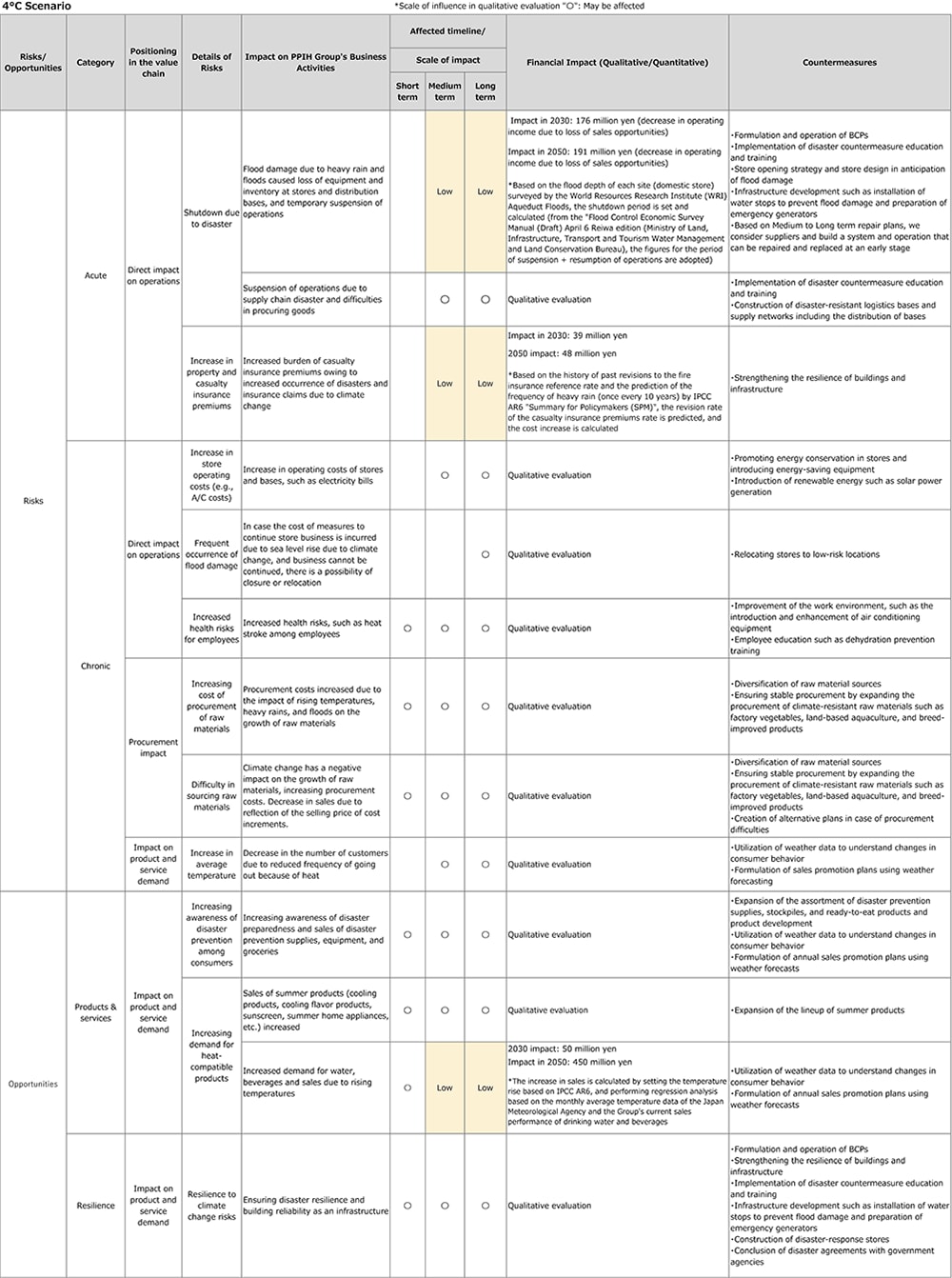

Strategy: Identification of significant risks/opportunities

PPIH Group operates over 700 stores in Japan and overseas, procuring and selling a wide variety of products tailored to regional needs.

With over 80% of its sales generated domestically, the Group expects climate change to have a relatively greater impact on its domestic operations.

For this reason, the scope of scenario analysis was defined as "domestic store operations" and "product procurement."

Based on the 1.5°C and 4°C climate scenarios, the Group identified risks and opportunities arising from climate-related changes in the social environment and evaluated the financial impact on its value chain processes across the short, the medium, and the long term timeframes. (Scenario analysis conducted in June 2025)

To ensure business continuity and expand opportunities under either scenario, the Group will implement the following countermeasures and respond flexibly and promptly to changes in the social environment.

- *1 Timeframes are defined as: Short term: up to 1 year, Medium term: up to 2030, Long term: up to 2050.

- *2 Financial impact within the value chain was assessed qualitatively and quantitatively based on "likelihood × magnitude of impact." (Risks and opportunities that could not be quantified were evaluated qualitatively, with likelihood assessed for each timeframe.)

Quantified impacts were rated on a three-level scale as below:

Financial impact settings... High: 3% or more of consolidated operating profit, Medium: Less than 3% to 1%, Low: Less than 1%

1.5℃ scenario

4℃ Scenario

Risk management

In the PPIH Group, the Compliance Promotion Headquarters manages risk incidents that occur mainly at stores and bases. Information collection, risk response, and countermeasures related to risk incidents are determined in cooperation with relevant departments, and stores and bases implement measures based on their instructions.

The Sustainability Committee identifies and evaluates climate change-related risks and opportunities, considers and promotes countermeasures, and manages them, and coordinates information with the Compliance Promotion Headquarters. We regularly monitor responses to risks, including those related to climate change, by conducting on-site inspections and other activities. The results are shared with relevant departments, and improvements are thoroughly implemented in collaboration with them. We also report significant risks to the Board of Directors as necessary.

Details of the process of identifying and assessing risks related to climate change

The Sustainability Committee evaluates the degree of impact on the value chain process on three levels (high, medium, and low) for each 1.5°C scenario × 4.0°C scenario based on the likelihood of impact and the magnitude of the impact, and plans, considers, and implements countermeasures. (See "Strategy" for details) Going forward, we will strengthen cooperation between the Compliance Promotion Headquarters and the Sustainability Committee to establish a system for recognizing and managing climate-related risks as company-wide management risks.

Metrics and targets

Recognizing that addressing climate change is an important issue for the sustainable development of the PPIH Group and the enhancement of corporate value over the medium to long term, we have set decarbonization targets with reference to Japan's NDC based on the Paris Agreement in order to respond to the risks related to CO₂ emissions identified through scenario analysis based on the TCFD framework.

The Group will work together to achieve its goals and regularly disclose progress. We will also consider countermeasures for other risks, formulate quantitative targets, and disclose initiatives to achieve them as needed, thereby promoting responses to climate change.

PPIH Group Decarbonization Targets

| Objectives (Target: Domestic Scope 1 and 2) |

Progress (compared to FY2013) | |||

|---|---|---|---|---|

| FY2022 | FY2023 | FY2024 | FY2025 | |

| 50% reduction of CO₂ emissions from stores by 2030(compared to FY2013) |

16%reduction | 20%reduction | 26%reduction | 33%reduction |

| Reduce the total amount of CO₂ emissions from stores to zero by 2050 |

||||

-Main Initiatives to Achieve the Goals

- ➀Improve the efficiency of energy use and reduce energy consumption in store operations by introducing air conditioning, refrigeration and freezer case control equipment, dimming lighting equipment, and thoroughly optimizing the set temperature and lighting time.

- ➁Creation of renewable energy such as solar power generation

- ➂Replacing with renewable energy using non-fossil certificate trading

Solar panels (MEGA Don Quijote Kofu)

In the future, we will expand the scope of our scenario analysis to include categories other than food products and overseas businesses to identify risks and opportunities. We will also work with our suppliers to build an environmentally friendly supply chain and improve the accuracy of our disclosure of Scope3 emission reductions.

- *Scope 3:

- Greenhouse gas emissions from the manufacturing of goods purchased by the company and from the use of the company's products by consumers

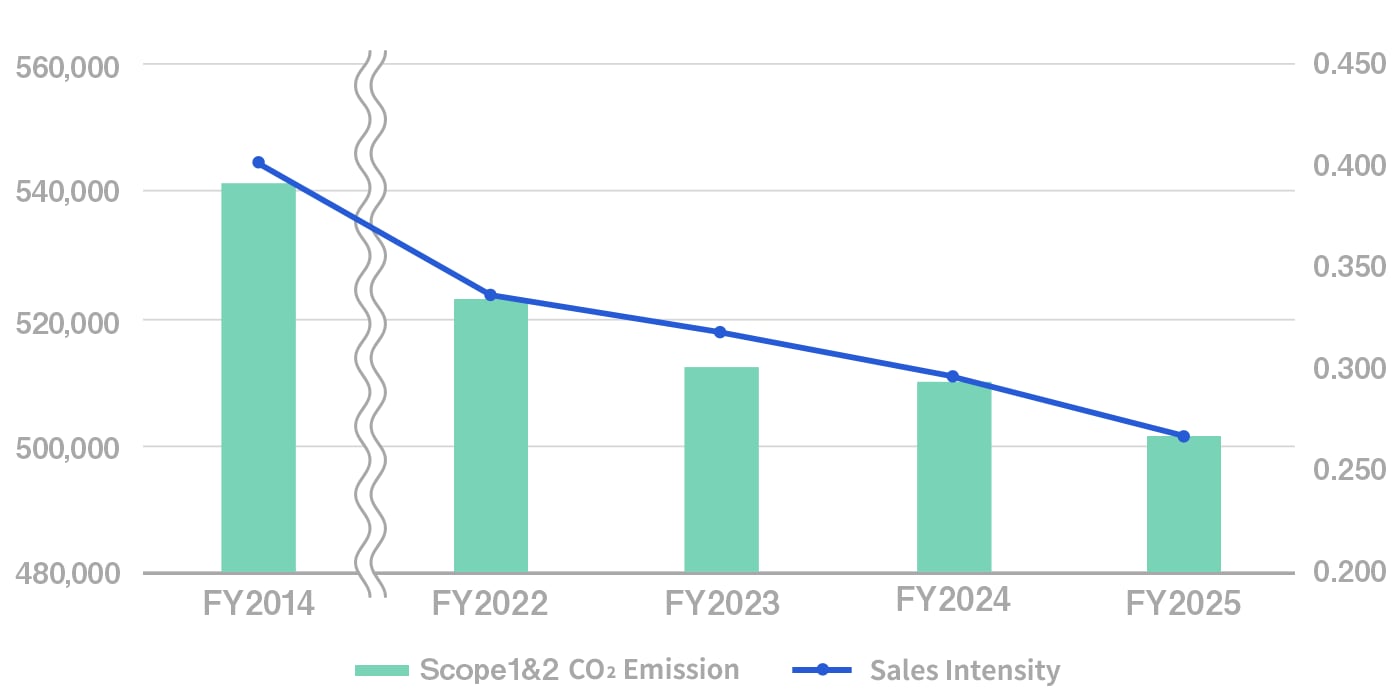

-Transition of CO₂ emissions and sales intensity

In the fiscal year ending June 2024, CO₂ emissions per unit of sales were reduced by 26% compared to FY2013, and by 33% in the fiscal year ending June 2025, and we are steadily moving towards our 2030 target, and our total volume is also declining.

| FY2022 | FY2023 | FY2024 | FY2025 | |

|---|---|---|---|---|

| CO₂ Emission Scope1 *1 *2 (t-CO₂) |

70,174 | 65,324 | 64,228 | 68,530 |

| CO₂ Emission Scope2 *1 *3 (t-CO₂) |

452,694 | 447,181 | 446,025 | 433,236 |

| Total | 522,868 | 512,505 | 510,253 | 501,766 |

| CO₂ EmissionsSales Intensity (Per million yen) |

0.336 | 0.319 | 0.296 | 0.269 |

- *1 Scope 1 and 2 are calculated based on "the Act on the Rationalization of Energy Use and Conversion to Non-Fossil Energy" and "the Act on the Promotion of Global Warming Countermeasures"

- *2 Scope 1: Calculated using the emission factors in reference to "List of Calculation Methods and Emission Factors in the Calculation, Reporting, and Disclosure System" by the Ministry of the Environment

- *3 Scope2:Calculated using the emission factors in reference to "Emission Factor by Electric Utility (for Calculating Greenhouse Gas Emissions of Specified Emitters)"by the Ministry of the Environment

CO₂ emissions