Ensuring thorough compliance

Purpose of the establishment of the Compliance Committee

The Compliance Committee, chaired by the director responsible for Legal and Compliance, is tasked with planning and verifying measures to prevent misconduct, as well as developing and assessing inspection and investigation procedures. Furthermore, the committee comprises 9 members, including directors, independent outside director (who serve as Audit and Supervisory Committee member) with legal qualifications, and executive officers. It is structured to facilitate advice from external legal counsel.

Additionally, to ensure the appropriateness of operations, the Committee manages matters regarding compliance and internal control, guarantees a strong sense of ethics in business activities, and strives to ensure the legal compliance and implementation of the corporate governance structure. Furthermore, responses to compliance risks are optimized by performing cross-organizational, Groupwide assessments and evaluations of these risks.

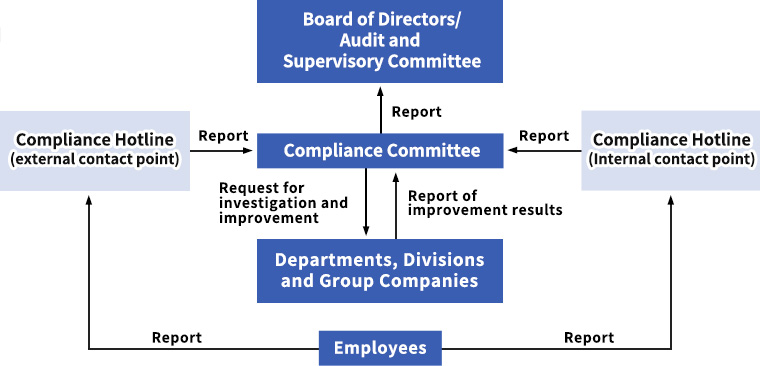

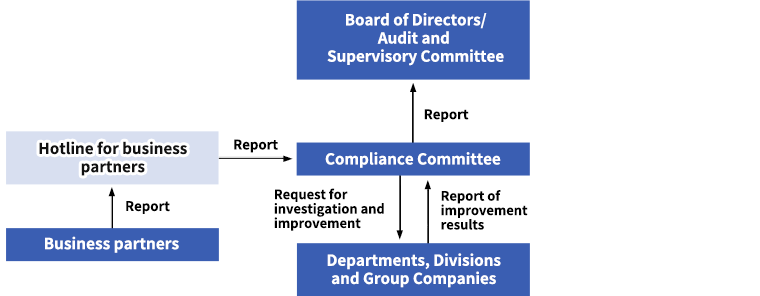

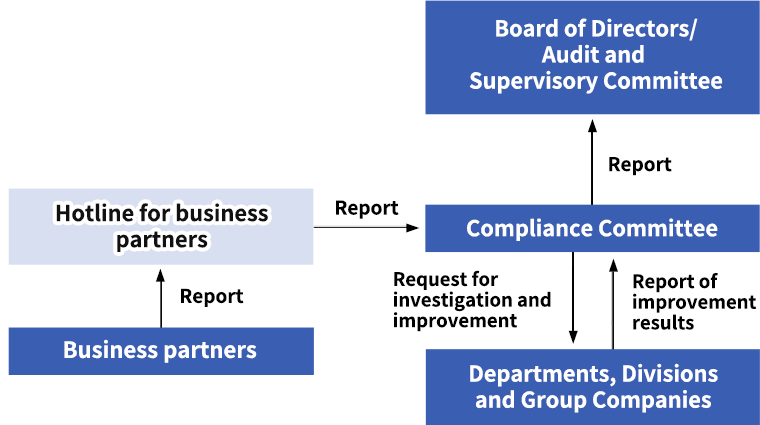

Whistle-blower system

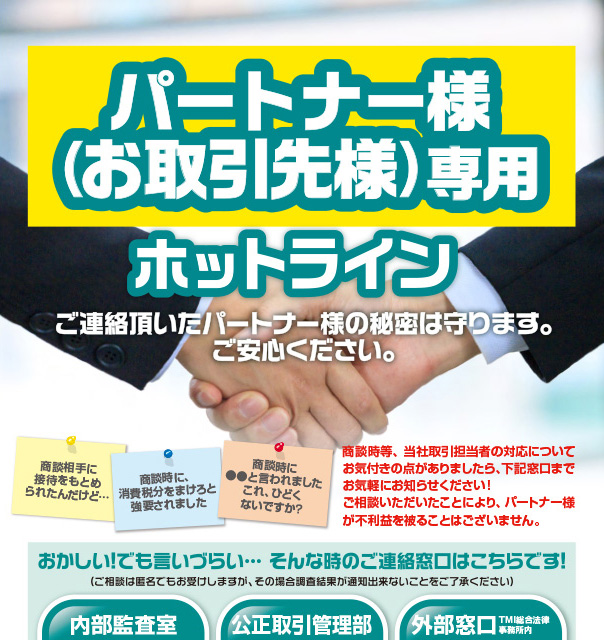

As part of strengthening compliance, the PPIH Group has a "Compliance Hotline" for employees to report violations of laws, regulations, and internal rules and regulations. The "Compliance Hotline" has two contact points, one with an external law firm and the other with an internal contact point, from which employees can choose to make a report. In addition, in order to maintain a moderate and sound relationship with our business partners, we have established a hotline for them so that they are able to report any concerns they may have about the actions of our Group's account managers. We take the opinions of our business partners seriously and work to promptly make improvements, ensure fair transactions, and build stronger relationships of trust. These hotlines are operated in accordance with internal regulations, and the contents of reports are discussed by the Compliance Committee and reported to the Board of Directors and the Audit and Supervisory Committee as appropriate.

The contents of reports made to these hotlines are treated with the strictest confidentiality, and anonymous reporting is also possible, with e-mails being accepted 24 hours a day. Whistleblowers are thoroughly protected by the company regulations, which state that whistleblowers shall not be subject to any disadvantageous actions such as retaliation or worsening of the work environment because of their reporting.

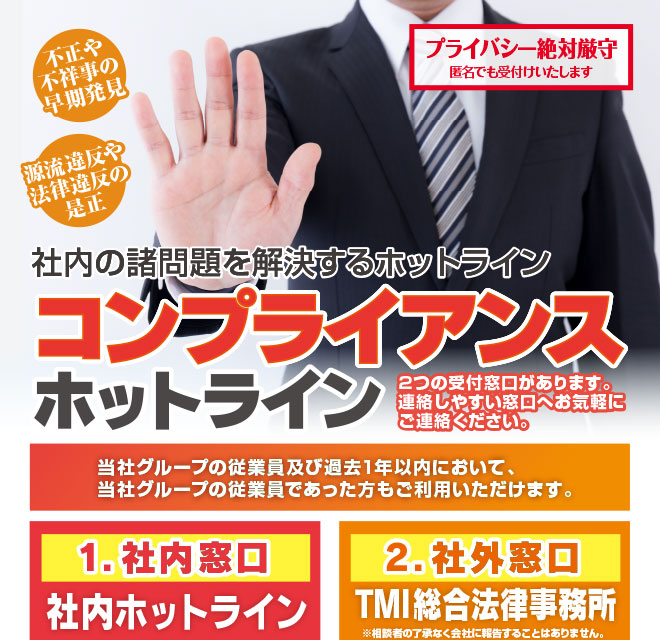

In addition, we actively introduce the "Compliance Hotline" in our company newsletter, monthly compliance training sessions, and internal posters in order to create an environment in which employees can use the hotline when necessary.

Internal poster of "Compliance Hotline

Poster of hotline for business partners displayed in business meeting rooms, etc.

Compliance awareness initiatives

The Group conducts training by rank with the aim of raising compliance awareness and preventing the occurrence of incidents. In addition to inviting outside lecturers to provide training for Executive officers on compliance risks that should be considered in management, we also conduct monthly e-learning compliance training for employees (full-time employees and contract employees*) in order to ensure thorough corporate compliance throughout the organization.

* UNY Co., Ltd. and UCS Co., Ltd. conduct compliance training for full-time employee

-Compliance training for Executive officers

Dec 2020 Insider Trading Prevention

Nov 2022 Regulations on Bribery

Jun 2023 Harassment Prevention

Executive officers at the training

-Compliance education & training for employees

Training for employees covers various topics related to the Group's business risks and materiality issues, and periodic tests are conducted in order to ensure that each and every employee has a thorough understanding.

(FY2024)

Monthly average number of participants:9,503

Monthly average attendance rate:85.8%

| Jul. 2023 | Sales rules for age-restricted products (Alcohol, tobacco, etc.) |

|---|---|

| Aug. | Harassment (Including sexual harassment and physical/mental harassment) |

| Sep. | Compliance training test |

| Oct. | Act against Unjustifiable Premiums and Misleading Representations |

| Nov. | Labor Standards Act |

| Dec. | Intellectual Property Rights |

| Jan. 2024 | Labor Contracts Act |

| Feb. | Information security (Act on the Protection of Personal Information) |

| Mar. | Compliance training test |

| Apr. | Laws related to sales promotion (Act against Unjustifiable Premiums and Misleading Representations, Pharmaceutical and Medical Device Act, Intellectual Property Rights) |

| May | Product quality control |

| Jun. | Act for Eliminating Discrimination against Persons with Disabilities |

Anti-Corruption Initiatives

Our Corporate Philosophy "The Source" states, "We commit ourselves to doing business in a manner that is unselfish, 100% honest, and grounded in a strong sense of morality and purpose. " In order to practice sound and fair business activities, we are thoroughly implementing group-wide anti-corruption initiatives in accordance with our corporate philosophy and code of conduct "The Source," and the "PPIH Group Anti-Corruption Policy," which was established with the approval of the Board of Directors. In addition, if any conduct that constitutes corrupt practices is discovered, it is to be reported through the "Compliance Hotline".

We also ask our business partners who are contract manufacturers of our private brand (PB) products, to thoroughly prevent corruption through the "PPIH Group Supply Chain Code of Conduct" and a questionnaire survey to self-check their compliance with the code of conduct.

Tax compliance initiatives

The PPIH Group has established the "PPIH Group Tax Compliance Policy" with the approval of the Board of Directors in order to fulfill its proper tax obligations in each of the regions in which the Group operates. In accordance with this policy, the PPIH Group will disclose its tax status appropriately. We do not use tax havens for the purpose of tax avoidance.

(Unit:Million Yen)

| Japan | North America | Asia | Total | |

|---|---|---|---|---|

| Net sales* | 1,763,062 | 246,875 | 85,140 | 2,095,077 |

| Income before income taxes | 140,169 | ▲6,484 | ▲3,179 | 130,506 |

| Arising tax amount | 45,783 | 1,449 | 163 | 47,395 |

* Net sales are based on the location of customers and are classified into countries or regions