Climate change (information disclosure based on TCFD recommendations)

We recognize that addressing climate change is a material issue for the PPIH Group's sustainable development as well as the enhancement of corporate value over the medium to long term. In order to accelerate and ensure our efforts, we endorsed the Task Force on Climate-related Financial Disclosures("TCFD")in February of 2022 and conducted scenario analysis and disclosure based on the TCFD framework. We will continue with our efforts to address climate change and expand disclosures.

Governance

With regard to responding to climate change, the Sustainability Committee, led by the Executive Officer in charge, the Representative Director and Senior Managing Executive Officer, CSO (Chief Strategy Officer), plans and proposes initiatives such as scenario analysis based on the TCFD framework, examining measures to address identified risks and opportunities, and reducing CO₂ emissions, waste, and plastic usage, and then reflects these initiatives in the business activities of the Group companies. In addition, the Sustainability Committee regularly reports on measures and activities to address climate change issues at Board of Directors meetings, and important initiatives are discussed and approved at Board of Directors meetings before being formulated and implemented.

Strategy: Scope of analysis

[1.5°C and 4°C scenarios]

![Strategy: Scope of analysis [ 1.5°C and 4°C scenarios ]](/en/sustainability/materiality1/climate_change/img/img_tcfd_scenario_en.png)

According to the Intergovernmental Panel on Climate Change (IPCC), the changes in global average temperature until 2100 will follow five scenarios depending on the fluctuation of CO₂ emissions. The scenario with the highest emissions causes a temperature rise of about 4.3°C which increases the physical risks due to the frequent occurrence of super typhoons.

On the other hand, the scenario with the lowest emissions will only rise by about 1.6°C. At this time, the world is said to be dramatically shifting to a decarbonized society, with the introduction of new regulations such as carbon taxes and the mainstreaming of EVs.

Although there are scenarios in between,(1)it is not strategic to plan countermeasures for all possible multiple futures, and(2)if countermeasures are taken at both ends, it will be easier to deal with the situation when the outcome falls in between (called a bookend scenario), so in this scenario analysis, we used the future projections of 4°C and 1.5°C.

-World Energy Outlook2021

-Net Zero by 2050

-Energy Technology Perspectives

The main source is the IPCC. Domestic data was supplemented by government documents (e.g., MLIT "Study Group on Flood Control Planning in Light of Climate Change").

-IPCC AR6 Interactive-atlas

Strategy: Identification of significant risks/opportunities

PPIH has identified risks and opportunities based on changes in the social environment in 2030 for the 1.5°C scenario, which assumes that strict policies and regulations will be implemented to move toward a decarbonized society, and the 4°C scenario, which is an extension of current policies. In the future, we will consider countermeasures in order to ensure business continuity under either scenario.

In addition to addressing risks, we will also make the most of the PPIH Group's unchanging "The ability to adapt" in order to respond flexibly and swiftly to changes in the social environment brought about by climate change as well as expand business opportunities.

1.5°C scenario, as of 2030

| Risk items | Anticipated changes in the social environment | Impact of risks | Risks/opportunities for the business | |

|---|---|---|---|---|

|

Transition risks |

Greenhouse gas (GHG) emission reduction requests (Introduction and increase of a carbon tax) |

-Introduction of regulations to reduce GHG emissions -Introduction of regulations to reduce food loss -Introduction of regulations for reduction of HFCs (chlorofluorocarbons) -Introduction of a carbon tax -Introduction of a carbon border tax |

Large |

Risks: -Higher store operating costs due to carbon price burden -Higher costs due to stricter regulations on food disposal -Higher equipment costs due to replacement with natural refrigerant equipment -Increase in procurement costs for products (beef, dairy products) Opportunities: -Demonstrating superiority by building a resilient supply chain -Expanding customer base of discounters due to growing preference for lower prices |

|

Introduction of plastic-free regulations (one-way plastic regulations) |

-Introduction of procurement and disposal regulations for one-way plastic materials -Increased demand for renewable plastic materials -Establishment of plastic recycling technology for various materials |

Medium |

Risks: -Cost increase due to replacement of plastic containers, packaging, and promotional materials with renewable resources Opportunities: -Reduce costs and increase sales by developing products with slimmer containers and packaging that take advantage of the discount business mode |

|

| Transition risks Technology |

Increase in demand for renewable energy and expansion of the amount created through the establishment of technologies |

-Rising demand for renewable energy and rising electricity prices due to fossil fuel regulations -Grid parity between renewable energy and normal electricity |

Medium |

Risks: -Soaring electricity prices, rising costs due to power certificate purchases Opportunities: -Enjoying incentives through early replacement of electricity derived from renewable energy sources |

|

Transition risks |

Change in reputation among stakeholders (investors, business partners, local communities, etc.) |

-Establish investment behavior, purchasing behavior, and hiring practices that take into account climate-related risks |

Medium |

Risks: -Reputational damage due to delayed disclosure of information. Negative impact on fundraising, branding, recruitment, and product handling Opportunities: -Expand fan base by enhancing sustainable products targeting young people in stores with high affinity for young people |

In terms of transition risks, we have calculated the impact of the introduction of carbon tax and its price increase for the purpose of reducing GHG emissions, as they are considered to be the greatest transition risks, For our estimate, we calculated the impact of carbon tax, assuming the tax would amount to $100/t in 2030, $144 in 2050, and we also calculated based on the assumption that emission factors for scope 2 electricity would be 51% lower than the present level.

-Total financial impact due to the introduction of carbon tax

2030: 3.93 billion yen, 2050: 5.621 billion yen

-Amount of carbon tax *1: $100/t in 2030, $144/t in 2050

-Electric power CO₂ emission factor *2: 51% reduction from the current level

- *1

- Estimated and set according to the forecast figures by the IEA NZE

- *2

- Emissions factor for electricity comes from the International Energy Agency(IEA)'s "Net Zero by 2050: A Roadmap for the Global Energy Sector (NZE)."

As stated in the "PPIH Group decarborization targets, "we aim to reduce 50% of CO₂ emissions from stores by 2030(compared to FY2013)and reduce the total amount of CO₂ emissions from stores to zero by 2050, and through the promotion of initiatives to achieve our decarbonization targets, we expect that the burden of carbon tax will eventually be eliminated. We will monitor our environmental performance and report regularly on GHG emissions related issues. We will also consider the introduction of internal carbon pricing to meet our decarbonization targets more efficiently.

4°C scenario, as of 2030

| Risk items | Anticipated changes in the social environment | Impact of risks | Risks/opportunities for the business | |

|---|---|---|---|---|

|

Physical risks |

Frequent occurrence of abnormal weather |

-Frequent occurrence of large typhoons and hurricanes -Increased frequency of flooding Insurance Premium Burden |

Large |

Risks: -Increase in damage to facilities due to wind and flood damage, and damage to profits due to business stoppage -Business shutdown due to supply chain damage - Increase in property insurance premiums Opportunities: -Ensure resilience against disasters by delegating authority to each store, and increase reliability as a lifestyle infrastructure |

|

Physical risks |

Rising Temperatures and High Tides |

-Increase in average temperature -Rise in sea level |

Medium |

Risks: -Increase in store operating costs (cooling costs, etc.) -Increase in flooding damage |

|

Decline in Agricultural Productivity |

-Food supply-demand crunch -Decline in production of grains (rice, wheat, beans, corn, etc.) |

Medium |

Risks: -Increase in procurement cost of food materials Opportunities: -Sales expansion due to increased demand for water and beverages |

|

For physical risks, we identified the increase of natural disasters due to frequent occurrence of large typhoons, flood, etc. as the biggest risk and calculated the impact. we assume that by 2050, rainfall at a level that occurs only once every 10 to 100 years in the present scenario will occur by the year 2050, as the IEA data shows that the flood frequency in Japan will be about four times the current level*1. Based on the planned scale (rainfall of about once every 10 to 100 years) of the hazard map (flood inundation area) by the Ministry of Land, Infrastructure, Transport and Tourism, we calculated(1)business loss due to business suspension,(2)merchandise damage due to flooding inside the store, and(3)damage to store facilities due to flooding that stores in the "Tokyo Metropolitan Area (Arakawa River)," "Chukyo Area (Shonai River)," "Kinki Area (Yodo River)" and "Kyushu Area (Chikugo River)" will suffer.

*1 From IEA NZE-Maximum business impact Per Store

-GMS stores: 2.44 billion yen

-DS Stores: 1.66 billion yen

-Small Stores: 202 million yen

To address the above risks, we have installed watertight panels, watertight doors, and other flood prevention equipment, as well as distributing sandbags at stores with a particularly high risk of flooding. Furthermore, in store areas where flooding has occurred in the past, we have changed display methods in order to prevent damage to products caused by flooding. We will continue to steadily implement measures to prevent damage from flooding.

Risk management

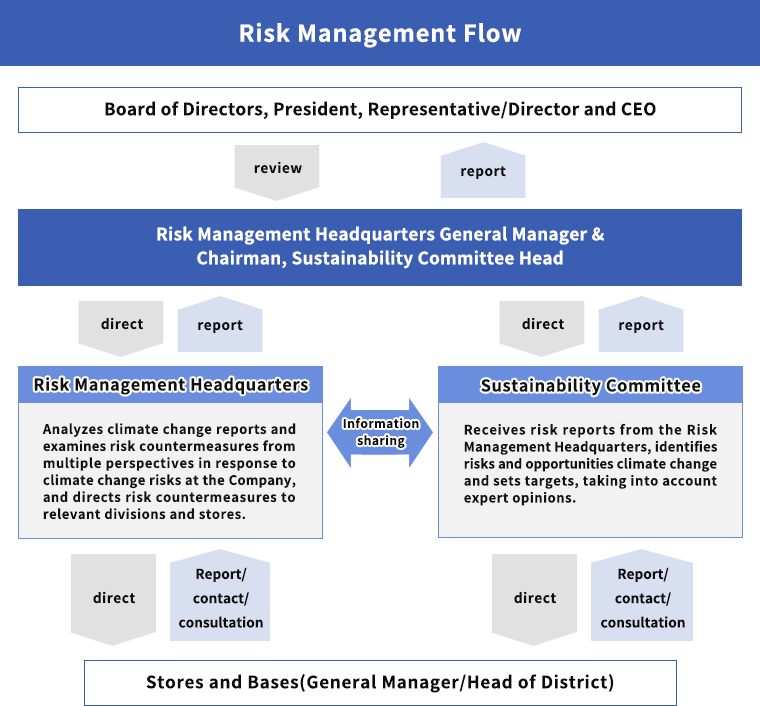

In the PPIH Group, the Risk Management Headquarters is responsible for risk management. The Risk Management Headquarters gathers information on risk incidents that occur at stores and bases, decides on risk responses and countermeasures, and stores and bases implement countermeasures based on these directions. Progress is monitored by the Risk Management Headquarters and reported to the Board of Directors as necessary.

In response to risks related to climate change, in the event of a large-scale disaster, we have a business continuity plan (BCP)as a basic principle, and in accordance with our management philosophy of "delegation of authority", our stores are able to flexibly assess the situation and respond quickly.

In the future, we will incorporate climate-related risks into our company-wide risk management, for example, the Sustainability Committee will identify, evaluate and manage climate-related risks, and we will establish a system to share issues with the Risk Management Headquarters.

Metrics and targets

In order to address the risks related to CO₂ emissions identified this time, the PPIH Group has set the following decarbonization targets, and the entire group will work together to achieve the targets and disclose progress on a regular basis. The PPIH Group will also consider countermeasures for other risks, formulate quantitative targets, disclose efforts to achieve the targets as needed, and promote measures to cope with climate change.

-PPIH Group decarbonization targets

Subject: Domestic, including offices and a logistics center

[Major initiatives to achieve the target]

- (1)Improving the efficiency of energy use in store operations and reducing energy consumption by installing control equipment for air conditioning and refrigerated/frozen cases and dimming equipment for lighting, and by ensuring that temperature settings and lighting hours are appropriate.

- (2)Creation of renewable energy sources including solar power generation

- (3)Replacement with renewable energy through the use of non-fossil certificate transactions

Solar panels (MEGA Don Quijote Kofu)

In the future, we will expand the scope of our scenario analysis to include categories other than food products and overseas businesses to identify risks and opportunities. We will also work with our suppliers to build an environmentally friendly supply chain and improve the accuracy of our disclosure of Scope3 emission reductions.

- *Scope 3:

- Greenhouse gas emissions from the manufacturing of goods purchased by the company and from the use of the company's products by consumers